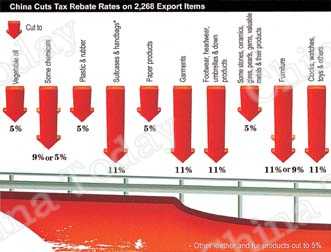

On July 1, 2007, China adjusted its tax rebate policy for some exports, in a move designed to engender significant changes in the nation's export industries. Rebates on 553 commodities were revoked and rates cut for another 2,268 items. The total number of affected exports accounts for 37 percent of the products listed under customs tariffs.

MA Yujie and her colleagues began working long extra shifts - from 5:30pm to the wee hours - as soon as the Chinese Finance Ministry announced it would be cutting tax rebates on many export products. Announced on June 19 and due to take effect on July 1, the changes would have a devastating impact on Sintalon Textiles Co., Ltd. where Ma works. The rebate on the company's main product of viscose fiber was to be pared from 11 to five percent, wiping out the operation's profit margin and more. The only short-term hope was to complete all orders and ship them before July 1. Seeing their boss in a distraught state, the staff didn't complain about the overtime, and of course were rewarded with extra wages.

The situation at Sintalon was mirrored all over the country, as the exports-driven textiles industry bore the brunt of the rebate cuts. According to statistics from Chinese customs, in the first half of 2007 the value of China's textile and garments exports rose more than 16 percent over the figure for the same period in 2006, further swelling China's already large foreign trade surplus and provoking loud complaints from foreign partners.

"The latest amendments to the export tax rebates are a key part of China's package of policies and measures to curb its foreign trade surplus," explains Wang Xiaohua, deputy director of the Tax Affairs Department of the Finance Ministry. Customs figures show that in the first five months of this year the gross volume of China's imports and exports hit US $801.3 billion, a rise of 23.7 percent over the same period for 2006. The country's accumulated foreign trade surplus soared to US $85.7 billion, a staggering 83.1 percent rise over last year's figure. This steep increase has escalated tensions with China's partners and exacerbated the country's excessive liquidity, placing mounting pressure on the Renminbi to appreciate. "In an effort to strike a balance in its foreign trade, the Chinese government is poised to deploy multiple policy tools to enhance and improve macro-control," says Wang. It is hoped the tax rebate cuts will engender a dive in the textile industry's export growth for the second half of 2007, thus reducing China's foreign trade surplus.

Many enterprises, however, complain that the rebate cuts came too abruptly, taking them by surprise. Zhang Jiansheng, general manager of the Shaoxing-based Douhan Textile and Garments Co., Ltd., recalls the last round of cuts in 2006 were announced with almost three months lead time. This time enterprises were only given a fortnight's notice. Like Sintalon Textiles, Zhang's company has been breaking its back to complete an order of Arab headbands and rush them through customs before July 1.

An Incentive to Make Products with Higher Added Value

The response generally to the new rebate policy varies amongst Chinese textile and garment exporters. Zong Guyin, president of Mengna Knitting Co., Ltd. in Yiwu, Zhejiang Province, sees it as a blessing in disguise. "Exports account for half of our sales. The rebate cut will affect our business in the short term, but do us good in the long run, as it pushes us to optimize our product structure."

A seasoned businessman, Mr. Zong has carefully followed China's trade disputes with foreign partners, and wasn't surprised when the changes to the tax rebates for exports were announced. The farsighted entrepreneur took a preemptive measure last June by setting up a factory in Hong Kong, at an investment of over US $12 million. Now the factory is a major manufacturer of the company's U.S and European orders. Since the new rebate policy doesn't apply to exporters in the Special Administrative Region, the factory didn't face the July 1 deadline imposed on mainland operations. The Hong Kong investment has also helped Mengna avoid international trade barriers. For instance, socks exported to the US from China's mainland are subject to quota limits, but those from Hong Kong aren't.

Of course, running a factory in Hong Kong is much more expensive than on China's mainland, the biggest disparity being labor costs. Mr. Zong offsets these costs with a higher added value for his Hong Kong products. His company has developed a slew of new items featuring advanced technology and new materials, which carry a much higher price tag than items produced on the mainland.

Although these measures have allowed Mengna to successfully weather the jolt to textiles exports created by the rebate cuts, Mr. Zong acknowledges the changes have devastated small, technically inferior players in the sector, who rely solely on the low price of their products to survive.

No More Growth at the Cost of Resources and the Environment

The tax rebate adjustments aren't just designed to curb China's growing trade surplus. The new policy has also removed rebates on 533 products deemed highly polluting or energy- and resource-consuming. As in the textiles industry, this will inevitably result in cost hikes for exporters. Wang Xinpei, spokesman for the Ministry of Commerce, admits the new rebate policy "is a real blow to some small and medium-sized enterprises," but adds, "It is designed to optimize China's export structure and transform its pattern of economic growth, and is therefore necessary."

One of the areas hit hardest by the pollution-targeting removal is the dye-stuffs industry. According to China Petroleum and Chemical Industry Association statistics, by May 2007 China had 480 dyestuff producers. However, a 2006 survey shows that only 24 of these reported an annual output exceeding 10,000 tons that year. Hordes of the industry's small to medium-sized enterprises are expected to be crushed under the mounting cost pressures triggered by the removal of the export tax rebate. This is good news for the environment, as many of these smaller operations are lacking in wastewater treatment facilities.

Pressure is also being felt by bigger players in the business, such as the Longsheng Group. Located in Shangyu City, Zhejiang Province, the group produces 360 products in three categories - dyestuffs, textile auxiliaries and chemical intermediates. Following the abrogation of the tax rebate the production costs of its dyestuff exports have risen rapidly. In response the group is shifting the focus of its business to other chemicals, including aromatic amine and slushing agents. It plans to increase the proportion of non-dyestuff products in its gross annual sales revenue and profit from 28.53 and 25.67 percent in 2006 to 43.73 and 36 percent respectively by 2009.

Despite the loss of many small companies, it is hoped the rebate adjustments will be of overall benefit to the nation. "The highly polluting and energy/resource-consuming products launched in China in recent years are mostly targeted at foreign markets, satisfying the needs of other nations at the cost of our resources and the environment, which is already facing a dire situation. The blind pursuit of economic growth not only leads to grim consequences for China's environment, but has also created high risks for the local economy and China's presence in the world market," says Li Yushi, vice president of the Chinese Academy of International Trade and Economic Cooperation. "By pulling the rug from under those enterprises eroding China's environment, resources and energy supplies, the new rebate policy can push Chinese manufacturers to move on from being world suppliers of primary products, to making industrial investments that will ultimately be of greater benefit to the nation."

Copy Reference

Copy Reference